Vedanta Limited Announces 3Q and 9M FY24-25 Results

Profit after tax jumps 70% YoY to ₹4,876 crore

• Highest ever 3rd quarter EBITDA of ₹11,284 crore, + 30% YoY

Net debt/ EBITDA at 1.4x (vs 1.7x in 3QFY24)

. Shareholders & creditors meeting for demerger on 18th February

Mumbai । Vedanta Limited today announced its Unaudited Consolidated Results for the Third Quarter ended 31st Dec 2024.

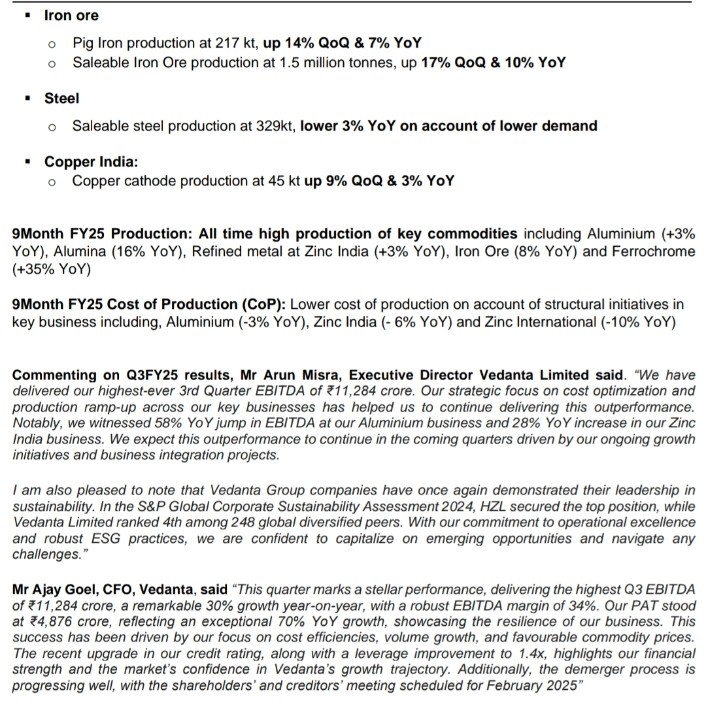

3QFY25 Financial Highlights:

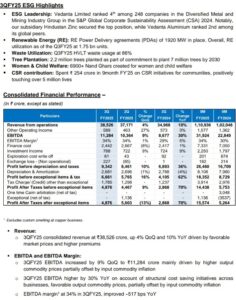

0 Consolidated Revenue of 38,526 crore, up 4% QoQ and 10% YoY

Consolidated EBITDA of ₹11,284 crore, up 30% YoY and 9% QoQ; Margin¹ at 34% up 517 bps YOY

Profit after tax (before exceptional) at 4,876 crore, up 70% YoY and 9% QoQ

Net Debt at ₹ 57,358 crores with Net debt/ EBITDA at 1.4x (vs 1.7x in 3QFY24)

Cash and Cash Equivalent improved by 66% YoY on the back of robust Free cash flow (pre-capex) of ₹ 6,766 crore

0 CRISIL upgraded long-term credit rating from AA- to AA with Watch Developing

Parent company, VRL successfully restructured $3.1 billion through bond issuances in the last 4 months resulting in longer maturities of up to 8 years, better covenants terms and a significant reduction in average coupon rate by 250 bps

Operational Highlights

3QFY25 key operational highlights across the businesses;

Aluminum

Highest ever Aluminum production of 613 kt, up 2% YoY

0 Record Alumina production at 505 kt up 7% YoY

Zinc India

Zinc India achieved lowest CoP in the last 15 quarters; CoP at 1041$/t down 5% YoY and 3% QoQ

Zinc International

Mined metal production of Zinc International at 46 kt up 12% YOY

D Zinc International delivered lowest CoP in last 7 years at 1181$/t down 31% YoY.